In an earlier article, we presented some highlights of a survey carried out for us by Skift Advisory, looking at service expectations of Canadian travellers. Our survey found two clusters of respondents: those who seek out and expect to receive a lot of direct service from staff while travelling, and those who prefer to be more self-sufficient while travelling. We promised that as soon as the international survey data became available, we would share it with you, and finally—after a very long wait triggered by global geopolitical tensions and instabilities, which can bias responses about international travel intensions—we are pleased to announce that the international data is in.

In September 2024, our partners were able to field the international survey, which collected responses from 2,551 people (500+ from each of Australia, France, Germany, India, and the United Kingdom). They were asked broadly the same questions as were asked of our domestic participants last winter, lightly adjusted to accommodate national or linguistic differences. As before, we continue to use service expectations as a stand-in for workforce skills. Perceptions of skills are very hard to study directly, but since there is a strong relationship between service standards and the skill level of the employees who deliver that service, asking about service expectations allows us to make some reasonably informed inferences about the perception of the skill level of the Canadian tourism workforce.

In this article, we present a summary of the findings of that data, and we invite readers to take a look at both reports. Next month, we will do some comparisons between the two, but for now, we wanted to focus on what the international report can tell us.

Overall Service Expectations

Overall, in the aggregate, 70% of the international travellers surveyed rated Canada’s service quality as “good (36%)” or “very good (34%).” Travellers from India had the highest service expectation rate (80%), followed by those from France (76%) and the United Kingdom (76%), highlighting Canada as a top destination in meeting consumer expectations compared to Italy, the USA, France, and the United Kingdom. However, only 58% of German travellers rated Canada’s service quality as “good” or “very good.”

There was no significant gender effect on service quality expectations for Canada. However, significant differences were observed in service quality perceptions based on marital status. Among respondents, widows reported the highest service expectations, with 74% rating Canada’s service quality as good or very good. In contrast, separated individuals had the lowest expectations, with only 60% rating it similarly. Single (67%), married (72%), and divorced (73%) individuals fell in between these two extremes. Furthermore, significant differences in service quality perceptions were noted across age groups. Respondents aged 45-64 had the highest expectations, with 75% rating the service quality as good or very good, followed by seniors aged 65 and older at 71%. Conversely, only 58% of travellers under 24 rated Canada’s service quality as good or very good.

What is perhaps more interesting is to look at the consumer profiles of those who expect good or very good service (those who chose 4 and 5 on a 5-point scale from very poor to very good), and those who have lower expectations (choosing 1 to 3). We can build these profiles through a comparison of cost appetite, influential factors in travel decisions, and preference for self-reliance while travelling. Each of these is briefly discussed below[1].

Cost Appetite

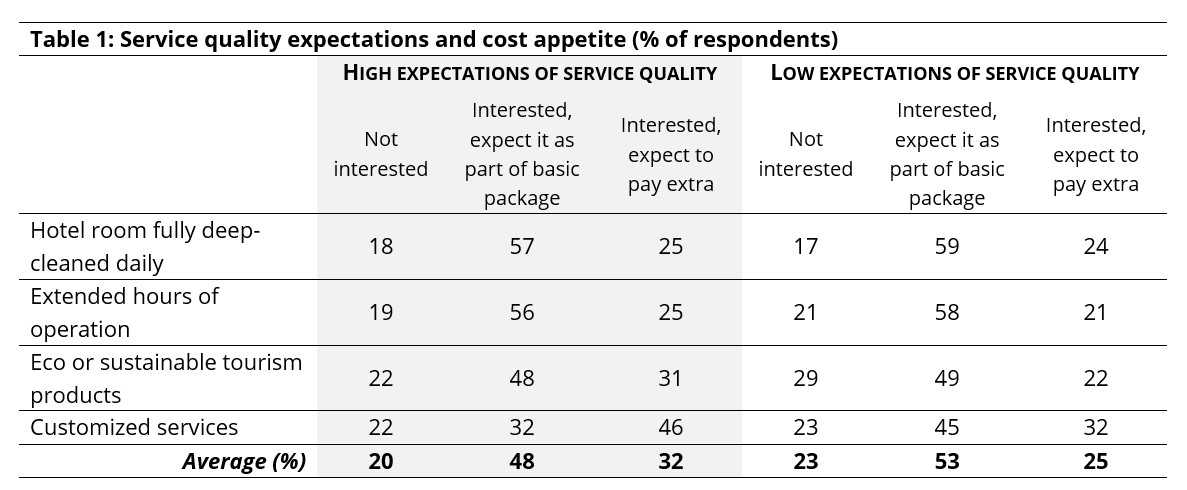

The first lens through which we can compare our two groups of travellers is cost appetite, which we can understand as interest in, and willingness to pay for, services that are increasingly being treated as premium or high-end by tourism businesses. The services presented in the survey were:

- A daily deep-cleaning of hotel rooms, as opposed to a daily light clean with deep-cleaning occurring less frequently during a multi-day stay

- Extended hours of operation, including earlier opening and later closing hours, as well as operating every day of the week

- The availability of ecologically sustainable or otherwise more environmentally friendly tourism products, such as low-emission options or offsets

- Access to customized or personalized services, such as one-on-one guided tours, childcare services, or airport transfers

Table 1 provides a summary of response rates across these four services for both groups of travellers.

Both high- and low-expectation travellers showed a strong preference for services to be included as part of the basic package, with slightly more low-expectation respondents (53%) viewing these services as essential compared to high-expectation respondents (48%). This expectation was particularly evident for foundational services, such as daily deep cleaning and extended hours of operation, which were widely regarded as basic standards by both groups. In general, travellers with high service expectations were more willing to pay extra for services (32%) compared to travellers with low service expectations (25%). Notably, travellers with high service expectations showed a significantly greater willingness to pay for eco-friendly (31% vs. 22%) and customized services (46% vs. 32%) than those with lower expectations.

Factors Influencing Travel Decisions

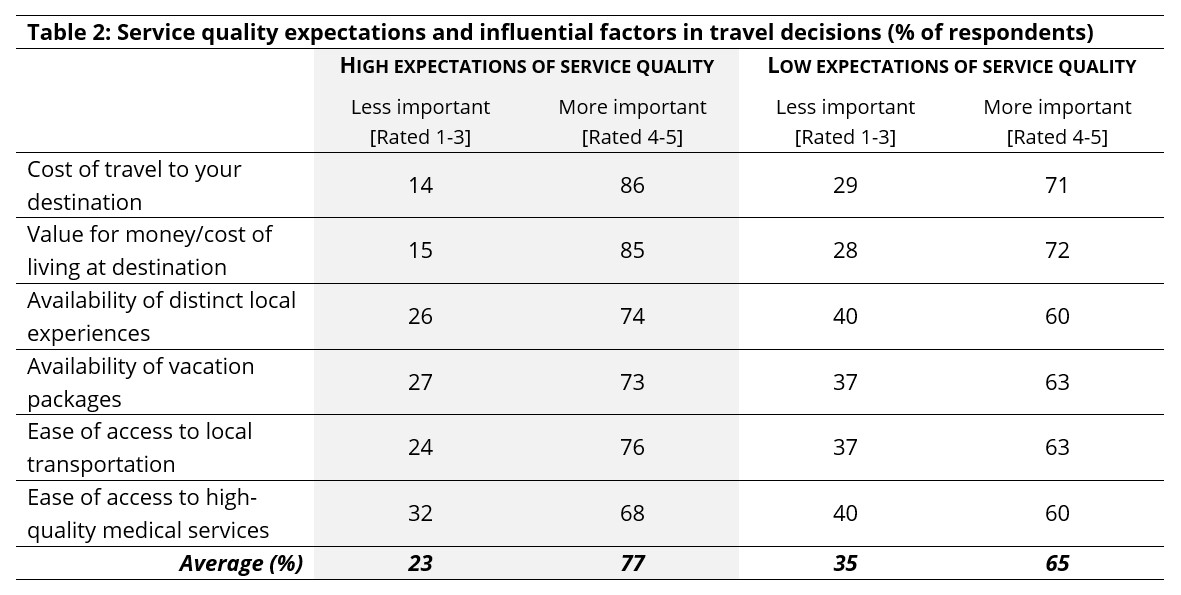

Another perspective we can take is to look at different factors that influence travel decisions. Survey respondents were asked to rate five factors on a scale of 1 to 5, where 1 meant “not at all important” and 5 meant “very important”. The factors they were asked to rate were:

- The cost of travelling to their destination. Transportation is often one of the larger expense items when travelling, and may deter some travellers coming from or going to particular regions of Canada.

- The value for money (or cost of living) at their destination. This includes costs for accommodations, food and beverages, and activities, which can also show pronounced regional differences across the country.

- The availability of distinct local experiences. The uniqueness of a destination is often an important consideration in deciding where to travel.

- The availability of vacation packages. This is important in travel decisions because it simplifies planning, offers cost savings, and provides travellers with convenient, all-inclusive options that enhance the overall travel experience.

- The ease of access to local transportation. This includes public transit options, taxis, ride-share availability, car rentals—once they have arrived, how easy is it to get around?

- Ease of access to high-quality medical services. Although no one hopes to get sick or become injured when travelling, knowing that care can be accessed if needed can influence travel decisions, particularly for those who are older or have underlying health conditions, and possibly also for those who pursue higher-risk activities.

Table 2 summarizes the survey responses, with ratings of 1 to 3 combined into the category “Less important”, and 4 and 5 into “More important”.

On average, travellers with high expectations of service quality rated these six factors as more important than those with low expectations of service quality (77% vs. 65%). For both groups, the two factors relating directly to money (cost of travel and value for money) had higher response rates of “more important”, although the preference was more pronounced among those with high expectations.

For the factors more related to local amenities (distinct experiences, transportation, and medical services) and availability of vacation packages, travellers with high expectations of service quality systematically rated those as more important, while those with low expectations rated them as less important.

For both groups, high-quality medical services were rated as somewhat less important compared to other factors, with high-expectation travellers at 68% and low-expectation travellers at 60%. This smaller gap implies that while both groups recognize the value of high-quality medical services, it may not be a critical driver in travel decisions for most travellers.

Preference for Self-Reliance While Travelling

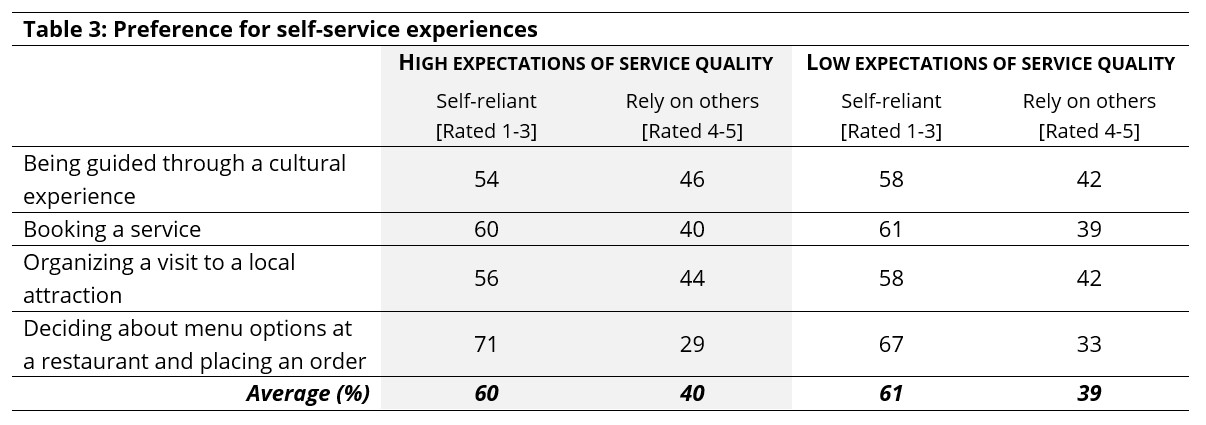

Finally, we can also look at responses between our two groups according to their preference for independence while travelling, versus expecting full service from tourism providers. Respondents rated four types of service on a scale of 1 to 5, where 1 corresponded to “I expect do it completely on my own”, and 5 corresponded to “I expect a member of staff to do all aspects for me”. The four services respondents were asked to rate were:

- Being guided through a cultural experience, such as at a museum or gallery, or in a cultural heritage centre or venue

- Booking a service, such as making reservations or arranging a taxi

- Organizing a visit to a local attraction, such as arranging transportation or advanced admission, or contacting tour providers

- Deciding about menu options at a restaurant and placing an order, which can range from entirely self-service (e.g., through an app or a tablet at the table, or ordering through a kiosk) to full table service (e.g., with a waiter or sommelier to provide advice and take orders)

Table 3 provides the responses, with ratings of 1 to 3 interpreted as a preference to be “Self-reliant”, and 4 and 5 as a preference to “Rely on others”.

Both groups of travellers expressed a consistent preference for self-reliance overall, particularly in activities that allow for personal choice and control, such as menu decisions. High-expectation travellers showed a marginally higher preference for assistance in cultural experiences and organizing visits to attractions compared to low-expectation travellers (46% vs. 42%).

Service Quality and Skills Expectations

While all travellers are broadly interested in cost efficiencies while travelling internationally, there are some other differences between those who have high expectations when it comes to service quality and those who have lower expectations. Our interest is in using service quality expectations as a tool for estimating expectations of workforce skills in the Canadian tourism sector, so it is worth taking a step back to consider what inferences we can draw from this sub-set of the survey data.

Given that both high- and low-expectation international travellers widely view foundational services—like daily deep cleaning and extended hours—as essential, tourism staff need strong operational skills to deliver these basic yet high-priority services consistently. Training in efficient housekeeping, hygiene protocols, and flexible scheduling to support extended operations is vital to meet these baseline expectations.

For international travellers with high service expectations, who are more inclined to pay extra for eco-friendly and customized services, the workforce can benefit from specialized training in sustainable practices and personalization techniques. Skills in eco-conscious tourism—such as minimizing waste, energy efficiency, and understanding sustainable product options—are increasingly valuable, as 31% of high-expectation travellers are willing to pay extra for eco-friendly options. Moreover, customer service training focused on customization and tailoring experiences will enable staff to provide the higher level of service expected by travellers willing to pay for individualized services.

As international travellers with high expectations place more importance on value-for-money factors and local amenities—like distinct experiences, local transport, and quality vacation packages—the workforce must also possess skills in tourism product development and local knowledge. Staff should be trained to enhance the perceived value of offerings through cultural fluency, local insights, and efficient planning, enabling them to meet the high expectations of travellers seeking unique, enriching experiences.

Finally, the observed preference for self-reliance, especially in areas like dining choices, suggests that tourism providers should design services that empower travellers with more autonomy. Workforce training in developing self-service options—such as easy-to-use booking systems, clear signage, and digital guides—can meet this preference for independence. However, as high-expectation travellers show a slightly greater preference for assistance in cultural experiences, staff should also be trained to offer optional, informed guidance and cultural insights for guests who seek a deeper connection with their destinations.

[1] Note that all values provided in tables 1 to 3 are percentages of responses, not raw scores. In all tables, “High expectations of service quality” refers to people who selected 4 or 5 on the 5-point scale of service quality expectations, and “Low expectations of service quality” are those who selected 1-3.