Increases to minimum wage in multiple jurisdictions in Canada created much controversy and press coverage. Depending on the source, predictions ranged from massive job losses as employers struggled with the higher costs, to an economic boost created by minimum-wage earners spending their pay on goods and services they could not previously afford. Debate covered the percentage of the increases, the implementation speed, and the influence of regional economic conditions—particularly rural versus urban.

Increases to minimum wage in multiple jurisdictions in Canada created much controversy and press coverage. Depending on the source, predictions ranged from massive job losses as employers struggled with the higher costs, to an economic boost created by minimum-wage earners spending their pay on goods and services they could not previously afford. Debate covered the percentage of the increases, the implementation speed, and the influence of regional economic conditions—particularly rural versus urban.

It’s a complex and politically charged subject, touching the whole economy. In tourism and hospitality, we see earnest employers trying to do the right thing for their staff, while having to work with thin profit margins. We see hard-working, dedicated employees trying to make ends meet as they pay for increasing housing, education, and food costs.

Most employers recognize the importance of compensation to productivity and to attraction and retention efforts—and media coverage has included profiles of employers supporting the increase, including those paying above minimum wage.

As an organization that represents the people that make up tourism and hospitality—10% of all workers in Canada—we explore the impact of the wage increases on all fronts: owners and operators of businesses of all sizes, managers, supervisors, and frontline employees.

The recently launched 2019 Canadian Tourism Sector Compensation Study provides a quantifiable look at the first year of these increases.

Over 2,100 employers from across the country shared the initial impact of minimum wage increases on their businesses, representing four tourism industries: food and beverage services, accommodation services, recreation and entertainment, and travel services.

While most regions of Canada implemented minimum wage increases in 2018, the increases in Ontario, British Columbia, and Alberta stood out as they were part of a move to a $15.00 minimum wage. The increase in Alberta was the final in a series of raises that saw the minimum wage increase from $10.20 in 2014 to $15.00 in 2018. On June 1, BC’s minimum wage rose to $12.65, the first of several increases that will see minimum wage reach $15.20 in 2021. Ontario saw the largest jump, from $11.60 to $14.00, although a further increase to $15.00 planned for January 1, 2019, was revoked.

So, what’s happened so far? Most organizations in BC (62.6%) reported being able to absorb the cost of the increase to a great extent or somewhat of an extent. Ontario, which saw the largest increase to the minimum wage in 2018, saw similar reporting (62.2%). However, Ontario businesses were more likely to say they had somewhat absorbed the increase, compared to BC where more said they had absorbed it to a great extent. Alberta’s employers, for whom the minimum wage has increased to the highest level in the country, reported being less able to absorb the cost of the increase in the minimum wage (52.3% somewhat or greatly absorbed costs).

To offset the costs, many tourism operators raised their prices (68.8% in Ontario, 64% in BC, and 59.6% in Alberta). Other common changes included cutting employees’ working hours, reducing hiring, increasing employee workload, and reducing hours of operation. A smaller proportion reported having to let staff go.

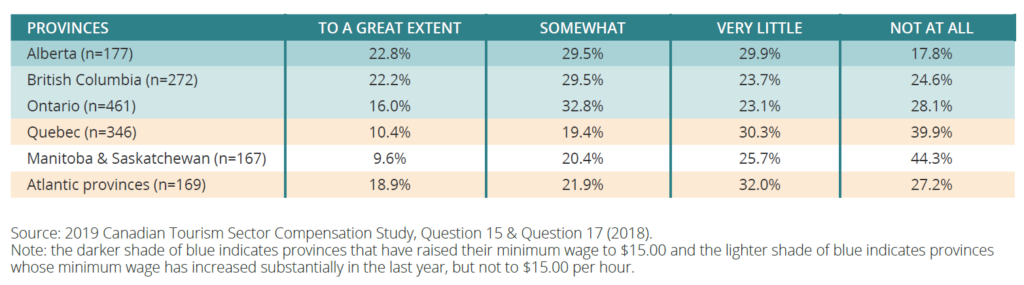

So can tourism employers afford a $15/hour minimum wage? Interestingly, businesses who had already adjusted or were on their way to adjusting to this rate were more likely to report being able to absorb the costs than regions where the change was not in the works (see chart below). This suggests the perception may be scarier than the reality. Tourism HR Canada will continue to measure and report on further changes to minimum wage are implemented across the country.

For the complete picture on minimum wage increases, access the 2019 Canadian Tourism Sector Compensation Study or visit the What’s New page for a look at our previously released report on Ontario’s Bill 148.