Tourism HR Canada recently released a new report, The Future of Canada’s Tourism Sector: Growth Aspirations Face Labour Challenges. As part of the research that led to this report, the Conference Board of Canada surveyed 400 tourism businesses across Canada. This Tourism Outlook and Labour Issues Survey gathered data on the issues affecting these businesses, including those related to labour. The survey asked about recent business performance and their expectations for the coming years.

The most significant challenges facing tourism businesses? Increasing operational costs and labour issues, reported by 69.0% and 63.3% of respondents, respectively. Other issues were reported to be challenging by a much smaller number of businesses. The third most prominent issue was the lack of prioritization of tourism in government policy decisions (reported by 31.5% of respondents), followed by concerns about the Canadian economy (27.3%), and concerns about competition from the sharing economy (26.3%).

Respondents who indicated that labour was a significant challenge were asked to rate specific issues as having a high, medium, or low impact on their business. According to respondents, a number of issues were having a significant effect on their businesses. The most impactful was the problem of finding qualified, reliable employees: 85.5% of respondents indicated this was a problem for their business. Respondents also reported that the wage expectations of potential employees were too high and that there was a shortage of skilled labour in their local area. Tourism businesses were additionally dealing with a lack of interest in tourism jobs amongst young workers and struggles retaining staff.

For the accommodations industry, the most difficult occupations for which to find and retain staff were housekeepers and cooks. Within the food and beverage services industry, cooks, kitchen helpers, and executive chefs were most difficult. More than 52.3% of accommodations industry respondents reported difficulties recruiting and retaining housekeeping room attendants, up from 44.0% in 2015. In food and beverage services, 46.4% of respondents indicated they had difficulty recruiting and retaining cooks.

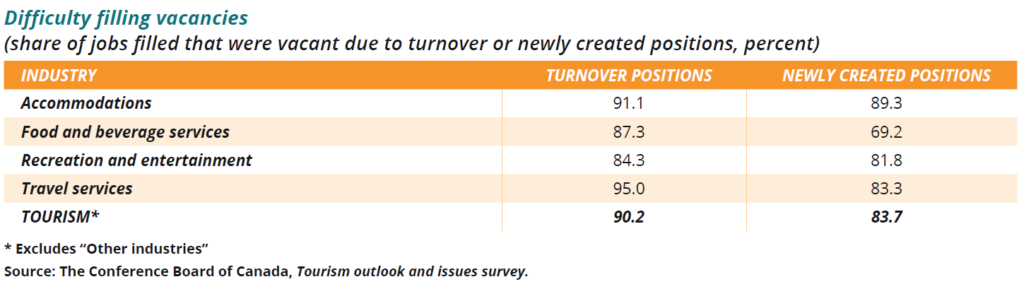

Respondents were also asked to identify the number of positions they wanted to fill at their establishment and the number of positions for which they were able to find workers, indicating how many positions remained vacant. Positions were divided into two types: existing positions that had been vacated due to turnover of existing staff and new positions that business owners wanted to create to accommodate expanding demand for their services. The results revealed that 9.8% of positions vacated due to turnover go unfilled, while 16.3% of newly created positions remained vacant. Food and beverage services businesses had the hardest time filling new positions, while recreation and entertainment businesses reported the greatest vacancy among positions created by turnover.

Almost half (47.0%) of tourism businesses reported increased revenues for 2018 (compared to 2017). Despite this, only 32.6% reported that business conditions improved compared with 2017. In fact, perceptions regarding business conditions were nearly evenly split between those who thought conditions improved (32.6%), stayed the same (34.4%), or weakened (30.6%) in 2018.

Increasingly problematic labour issues may cause the perceived weakening of business conditions in spite of increasing revenue. When asked about the tangible impacts tourism businesses face due to labour issues, respondents said that they caused increased labour costs, which in turn force them to raise prices, which curtails demand. They also cause businesses to scale back on the services they offer and what services they do offer may be reduced in quality.

Under these conditions, businesses are concerned about long-term reputational damage—which they may see as undermining their long-term viability.

Looking forward, a large share of respondents expects the challenges they face today to prevail. Looking at the next three to five years, 78.3% of businesses expect operational costs to be a significant challenge and 69.5% expect labour issues to be a significant challenge.

The findings of this survey were used to shape the final projections of labour supply and demand in Canada’s tourism sector. Those projections show 93,000 jobs that could exist due to demand by 2035 going unfilled because there are not enough workers to fill those jobs. The demand that goes unmet due to these shortages will leave $10.1 billion in tourism revenue on the table—that’s 3.2% of all revenues that the tourism sector could earn over the study’s forecast horizon.

The full results of the survey, including information on expectations for tourism demand over the next 12 months, can be found in the full report, The Future of Canada’s Tourism Sector: Growth Aspirations Face Labour Challenges, available from emerit.ca.

For more information on the study and its results, download the free national summary or purchase our Rapid reSearch tool to access data on expected shortages by region, industry and occupation.