Food and Beverage Services Pulls Sector into Growth

Overall, the tourism sector[1] in April saw slight labour force growth from the previous month[2], driven primarily by increases in food and beverage services, and supported by smaller increases in transportation. The sector was in a generally stronger position than in April 2023, but remained below 2019 levels.

At the industry group level, the profile overall was varied.

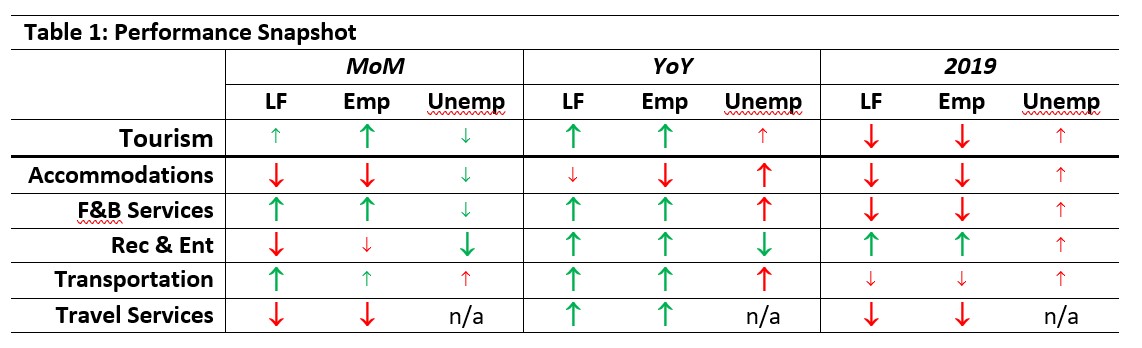

Table 1 provides a snapshot of tourism’s and each of its five industry groups’ performance across labour force, employment, and unemployment, as compared with March 2024 [MoM] and April 2023 [YoY], and with April 2019 as a pre-pandemic baseline. Small arrows represent changes of less than 1%, or less than one percentage point (pp) in the case of unemployment.

Food and beverage services saw growth in both labour force and employment from March (+4.2% and +5.3%, respectively), while transportation saw smaller gains in labour force (+1.3%) and employment (+0.7%). Accommodations, recreation and entertainment, and travel services all contracted from March. All industry groups except for accommodations were in a substantially stronger position than last year. Only recreation and entertainment had surpassed April 2019, with all other sectors remaining below pre-pandemic levels for both labour force and employment.

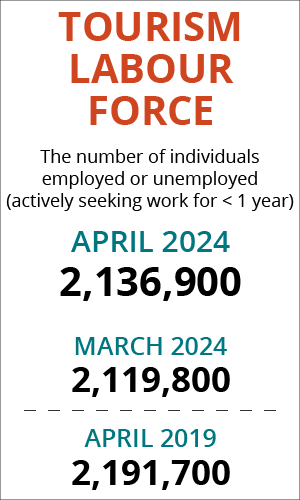

Tourism Labour Force

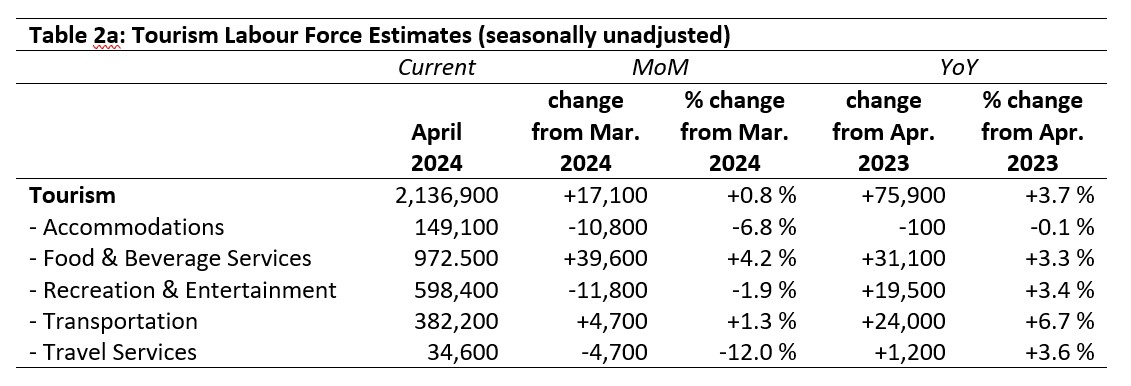

The tourism labour force[3] in April 2024 accounted for 9.8% of the total Canadian labour force, which held steady from March, and also from April 2023, although it remained a full percentage point below the April 2019 share. Overall, the sector’s labour force was 97.5% of its 2019 size. Tables 2a and 2b provide a summary of the tourism labour force as of April 2024.

March 2024: Month-over-Month

The overall tourism labour force increased by just over 17,000 people in the past month, the bulk of which was accounted for by a nearly 40,000-person increase in food and beverage services. The largest absolute loss was in recreation and entertainment (nearly 12,000), but the largest relative loss was in travel services (-12.0%). Recall that in March, travel services saw a substantial increase from February, which seems to have been a departure from broader trends rather than a broader shift in direction for the industry. Accommodations likewise saw a contraction of its labour force, losing around 6.8%.

April 2023: Year-on-Year

Relative to one year ago, the labour force overall had grown by around 3.7%, a net increase of nearly 76,000 people. Accommodations was the only industry group not to have gained labour force over this period, instead losing around 100 workers (representing a decrease of only 0.1%, so essentially remaining unchanged). The largest absolute gains were seen in food and beverage services, which saw an additional 31,000 enter the labour pool; the largest relative increase was in transportation, which grew by 6.7%.

April 2019: Pre-pandemic Baseline

The sector overall saw a net decrease of around 55,000 people in the labour force from April 2019, a contraction of 2.5%. Transportation was largely unchanged, while travel services had shrunk by 32.2% and food and beverage services lost nearly 64,000 people. In contrast, recreation and entertainment grew its labour force by around 55,000, a gain of 10.1%.

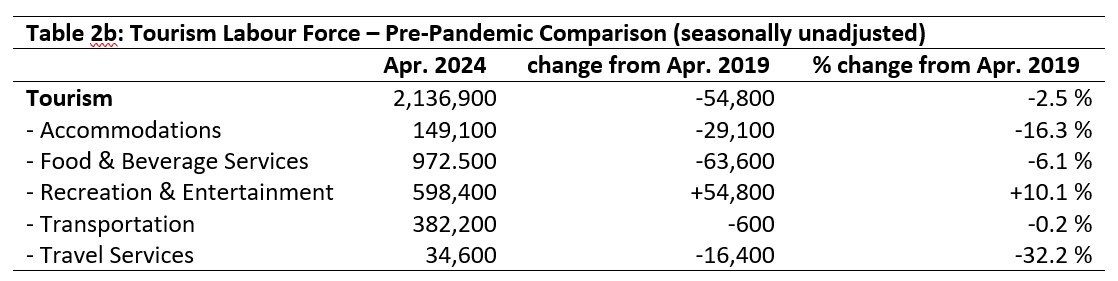

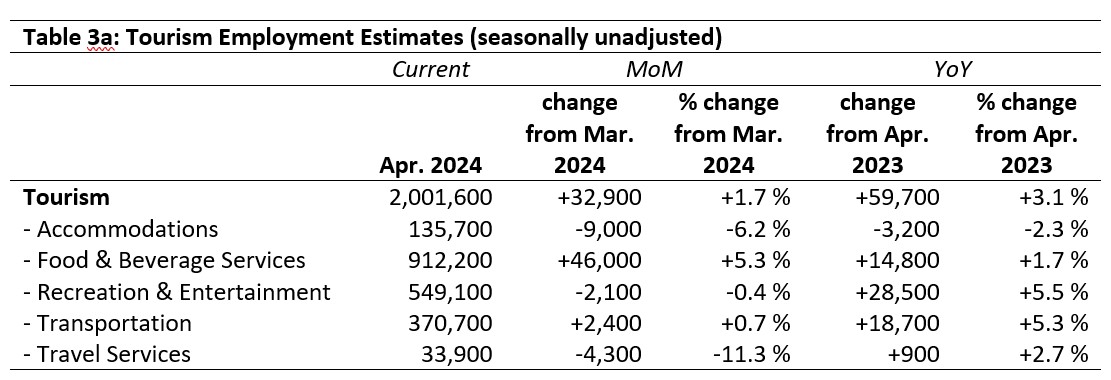

Tourism Employment

Tourism employment[4] accounted for 9.8% of all employment in Canada, and around 9.2% of the total Canadian labour force worked in a tourism industry. Tourism’s share of the Canadian labour force increased 0.1 percentage points from March while its share of employment held steady; both indices were on par with April 2023, but around one percentage point below 2019 levels. Tourism employment overall was 97% of what it was in April 2019. Tables 3a and 3b provide a summary of tourism employment as of April 2024.

March 2024: Month-over-Month

Over the past month, employment in tourism industries grew by around 33,000 people, an increase of 1.7%. This was carried almost entirely by strong growth in food and beverage services, which saw gains of 46,000 people in employment. The only other industry that saw gains in employment was transportation, which increased its workforce by a more modest 2,400 people (+0.7%). The largest absolute loss of employees was in accommodations, which contracted by 9,000 people; the largest relative loss was in travel services, which shrank by 11.3%.

April 2023: Year-on-Year

Compared to last year, the sector’s employment was up by 3.1%, representing nearly an additional 60,000 workers based in tourism industries. This growth was more evenly distributed across industry groups than the month-over-month changes: accommodations was the only group to have lost workers (-2.3%, or 3,200 people). The strongest growth was seen in recreation and entertainment, which added nearly 29,000 workers (+5.5%). Even travel services, which has struggled since the pandemic to see consistent regrowth, gained around 900 workers over the past year, an increase of 2.7%—although it should be noted that, because of its size relative to the larger industry groups in the tourism sector, small absolute increases can become amplified through conversion to percentages, so this remains a modest increase overall.

April 2019: Pre-pandemic Baseline

Tourism employment remained around 3% below where it was in 2019, a net deficit of nearly 62,000 workers. Recreation and entertainment alone had gained employees since the pandemic, posting an increase of 48,000 people (growth of 9.6%). Transportation remained largely unchanged (-0.6%), while food and beverage services saw the largest absolute loss of workers (63,800) and travel services saw the largest relative loss (-32.6%).

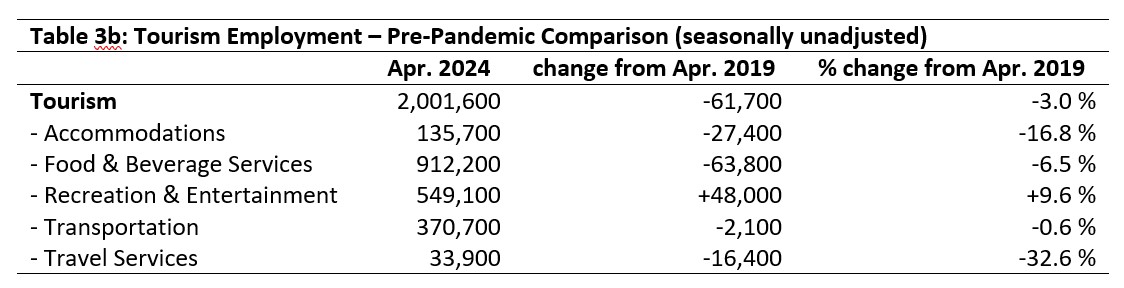

Part-time vs. Full-time Employment

Given the volatility of tourism sector employment over the past four years, gauging the ratio of part-time to full-time workers can provide useful insights into the overall composition and stability of the workforce. Before the pandemic, the sector tended to have around 40% of its workforce in part-time positions (using the Statistics Canada definition of part-time work: fewer than 30 hours per week), with key differences between industry groups. Patterns of persistent deviations from these pre-pandemic ratios can reflect realignment of the tourism workforce under the ‘new normal’ conditions to which the sector continues to adapt. Figure 1 provides an overview of the percentage of part-time employment across the industry groups.

The sector’s overall share of part-time workers fell slightly from March (-0.6 percentage points), but remained higher than in April 2019 (41.6% versus 39.3%). Year on year, the part-time share has generally been increasing, which may indicate a gradual shift, although the numbers as yet are not huge and seem—upon closer examination of the industry groups—to be largely driven by changes in food and beverage services, which is not only the largest employer by volume of workers, but also has the highest rates of part-time workers. In the past four years, the part-time share of its workforce has increased by 5.2 percentage points.

Recreation and entertainment has had a variable profile since 2019, but its part-time share of employees in April 2024 was only slightly higher than in April 2019. Accommodations seems to be settling at around 23% or 24% part-time workers, lower than pre-pandemic rates. Transportation likewise seems to be settling at around 18% or 19% part-time workers, also lower than pre-pandemic rates. Travel services has recovered to its pre-pandemic ratio of part-time workers after a substantial fall-off at the height of the pandemic restrictions.

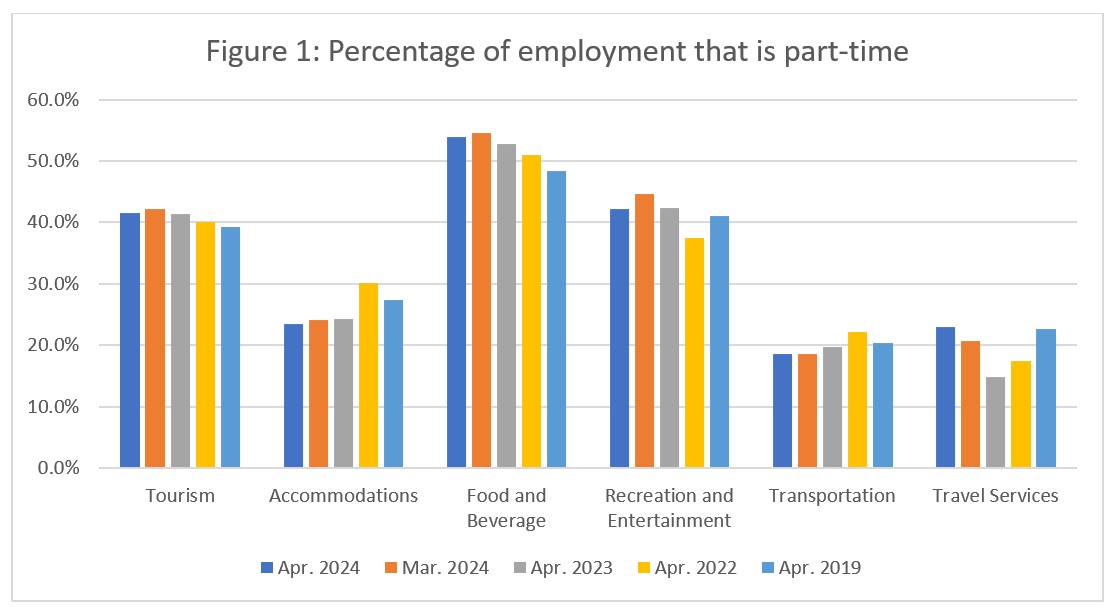

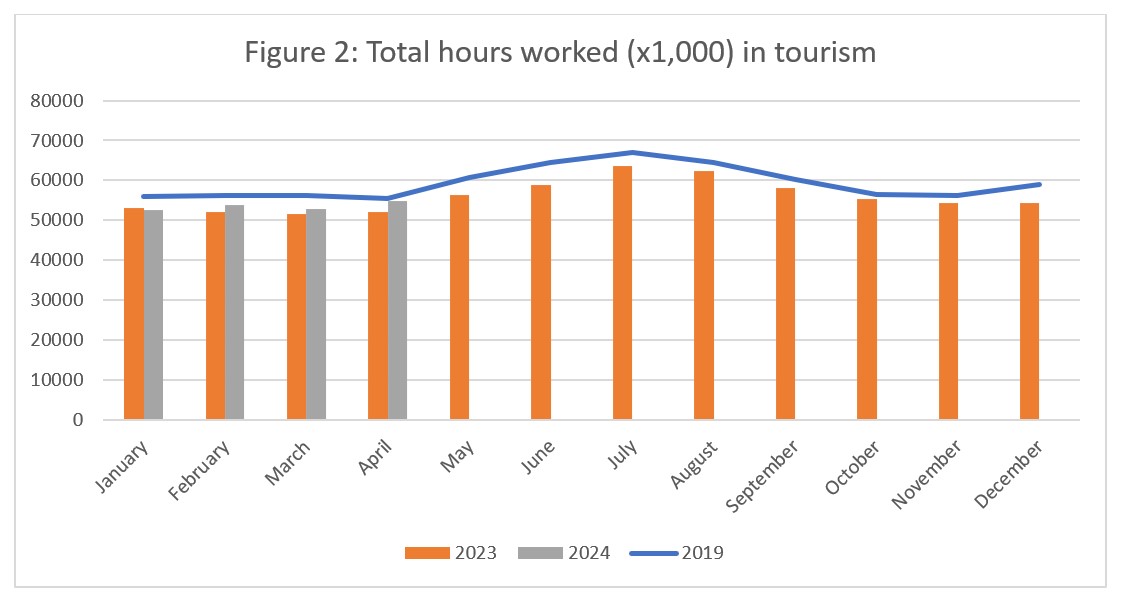

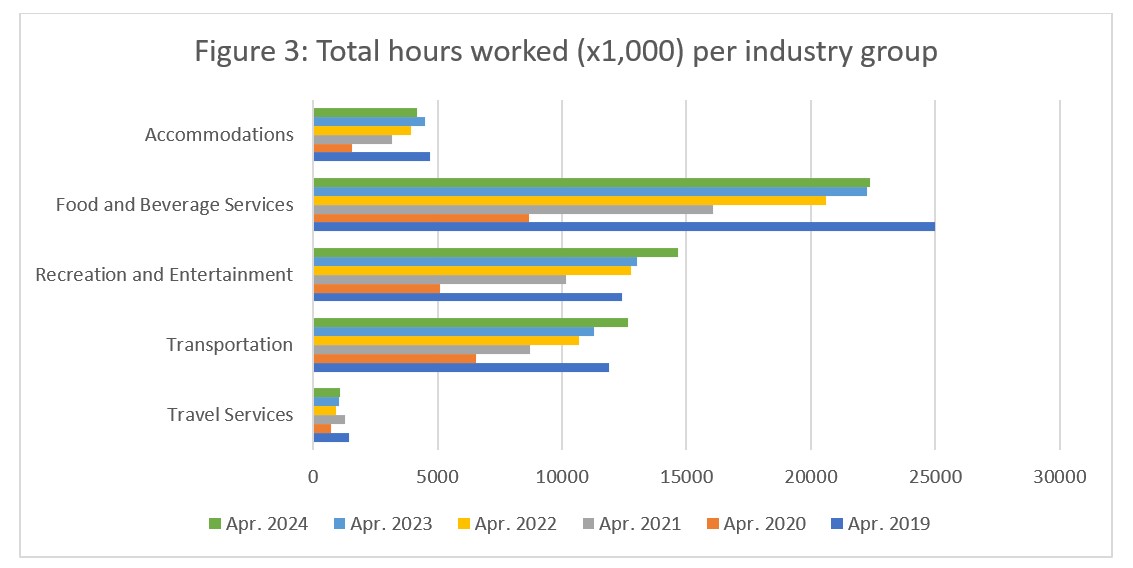

Hours worked

Another useful metric with which to assess the overall health of the tourism labour market is the total number of hours worked (see Figure 2). This index can reflect more immediate changes in consumer demand, as operators—particularly in those industries with a high share of part-time workers—can adjust payroll hours more responsively and on shorter notice than they can make fundamental changes to their employment roster.

Since February, the total hours worked in tourism have been consistently higher than in 2023, though generally below 2019 levels. However, the pre-pandemic gap narrowed considerably in April: in March, total hours worked were 6.3% below 2019 levels, while in April that number fell to 0.9%. This may indicate that the summer surge period is starting early in terms of customer demand, in response to a mild spring. It will be interesting to see how hours worked tallies over the course of the summer, which by some estimates should be bracing for another year impacted by wildfires, droughts, and floods.

Figure 3 breaks down the total hours worked by industry group and presents a year-over-year comparison starting in 2019. Transportation and recreation and entertainment have surpassed 2019 levels (+12.3% and +12.7%, respectively), continuing steady year-on-year increases since the abrupt drop from 2019 to 2020. Food and beverage services has likewise seen a straightforward increase since the most disruptive period of the pandemic, although the yearly increase fell dramatically from 2023 (+8% increase in 2023, and only 0.5% increase in 2024), and the industry group has not yet recovered to pre-pandemic levels. In accommodations alone, the total hours worked fell relative to last year (a drop of around 7.7%), while travel services saw a very slight increase (3.6%) over the same period.

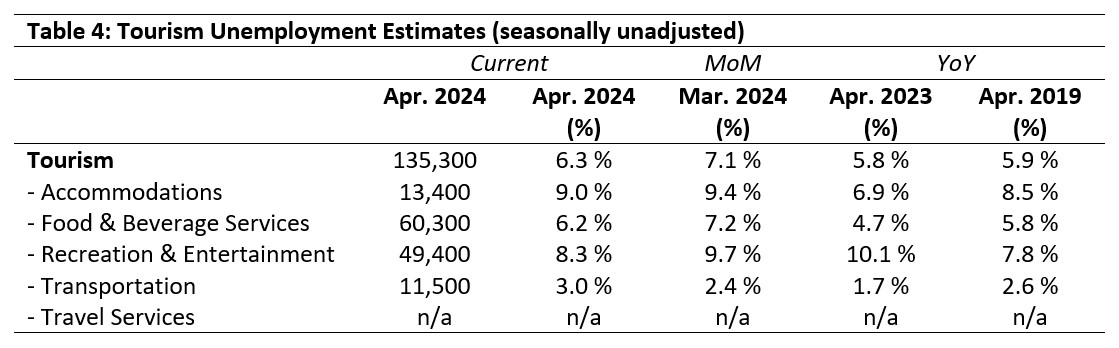

Unemployment

Unemployment[5] in the tourism sector in April 2024 was 6.3%, slightly higher than the economy-wide national average (6.2%, using seasonally unadjusted data). The unemployment rate was lower than it was in March, but higher than in April 2023 or 2019. Table 4 provides a summary of tourism unemployment in April.

March 2024: Month-over-Month

The unemployment rate fell month-over-month in accommodations (-0.4 percentage points), food and beverage services (1.0 percentage points), and recreation and entertainment (1.4 percentage points), while it rose slightly in transportation (+0.6 percentage points). No data was available for travel services.

April 2023 and 2019: Year-on-Year

At the sector level, unemployment rates for April 2024, 2023, and 2019 were not markedly different from each other, although that surface similarity masks variation at the industry level. Unemployment is calculated using the labour force and employment estimates, so reflects general workforce instabilities; tourism has had a difficult four years, and those difficulties have not been felt the same way, or to the same extent, across industry groups.

Accommodations showed a substantial increase on April 2023, and was much closer to 2019 levels. Unemployment rates in food and beverage services fell between 2019 and 2023, but rose again in 2024, surpassing the April 2019 unemployment rate. The unemployment rate in recreation and entertainment fell from last year, but was higher than in 2019. In transportation, April 2024 saw a near doubling of the figure from April 2023, and was also higher than in April 2019. No data was available for travel services.

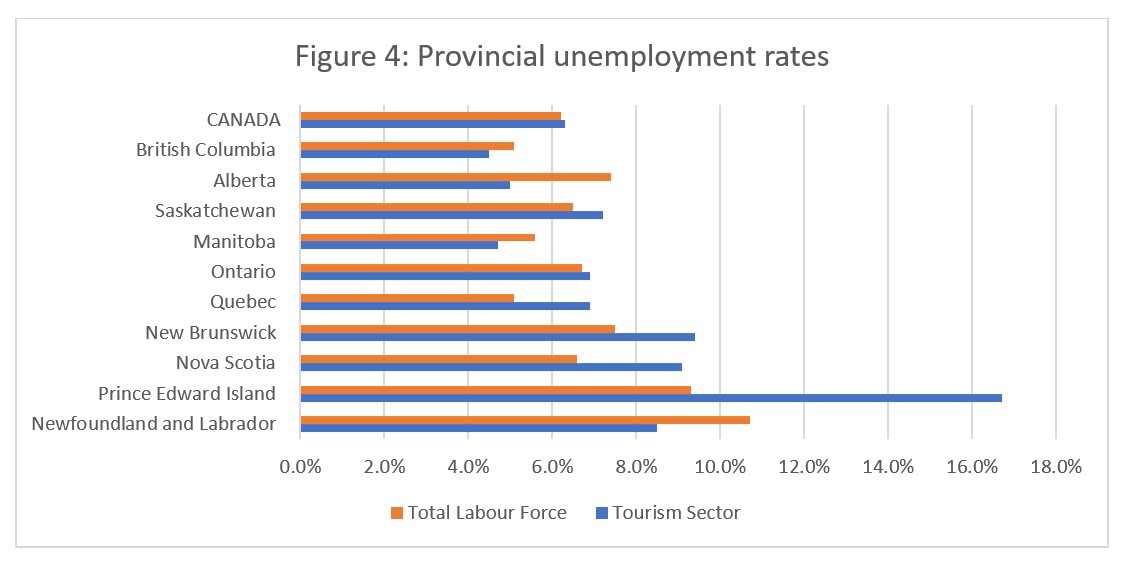

Provincial Tourism Unemployment

At the aggregate national level, unemployment in tourism was slightly higher than across the wider economy, a pattern which held steady across the majority of the provinces (see Figure 4). Only in British Columbia, Alberta, Manitoba, and Newfoundland and Labrador were the tourism unemployment rates lower than those of the total provincial economies. The unemployment rate gap between tourism and the total economy was most pronounced in Prince Edward Island, which also had the highest tourism unemployment rate by some distance (16.7%). The next highest unemployment rate in tourism was in New Brunswick (9.4%), while the lowest tourism unemployment rate was in British Columbia (4.5%), followed by Manitoba (4.7%).

View more employment charts and analysis on our Tourism Employment Tracker.

[1] As defined by the Canadian Tourism Satellite Account. The NAICS industries included in the tourism sector those that would cease to exist or would operate at a significantly reduced level of activity as a direct result of an absence of tourism.

[2] SOURCE: Statistics Canada Labour Force Survey, customized tabulations. Based on seasonally unadjusted data collected for the period of April 14 to 20, 2024.

[3] The labour force comprises the total number of individuals who reported being employed or unemployed (but actively looking for work). The total Canadian labour force includes all sectors in the Canadian economy, while the tourism labour force only considers those working in, or looking for work in, the tourism sector.

[4] Employment refers to the total number of people currently in jobs. Tourism employment is restricted to the tourism sector, while employment in Canada comprises all sectors and industries.

[5] Unemployment is calculated as the difference between the seasonally unadjusted labour force and seasonally unadjusted employment estimates. The percentage value is calculated against the labour force.