Tourism boasts a very diverse workforce: some industries employ large numbers of recent immigrants and temporary foreign workers, and many employers go out of their way to welcome and sustain a culturally rich roster of employees. Because the sector spans so many different types of enterprises across a wide array of industries, there’s also a lot of diversity in terms of age: some businesses orient more towards older employees on a long-term basis, while others draw on a younger workforce with a higher turnover. There is no one-size-fits-all description for who is the ‘average’ tourism employee, and the fact that there is a place for everyone in tourism is one of the sector’s strengths.

This diversity, however, is not necessarily evenly distributed throughout the sector or its constituent industry groups. For industries and businesses that tend to rely on a limited demographic slice of the population to meet staffing needs, this can pose risks in terms of recruitment and retention. If the ‘usual’ demographic of workers becomes unavailable for some reason, it can be difficult to pivot quickly to attracting other workers, particularly if the industry has a strong social association with one group.

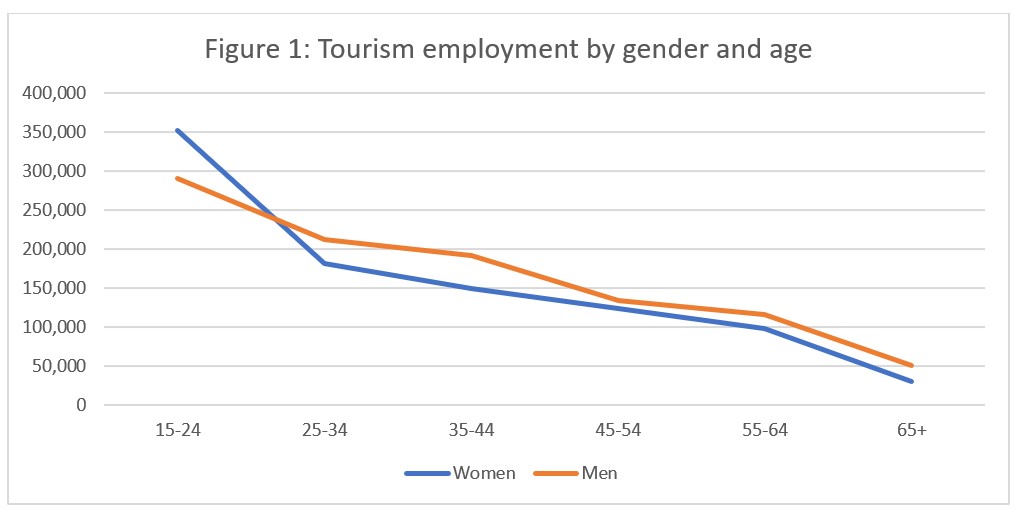

Although age and gender are very broad categories through which to assess the makeup of the tourism workforce, they do provide a good entry point to begin the conversation. Figure 1 provides an age and gender breakdown of employment across the sector as a whole, as of April 2023.

Unsurprisingly, there is a steady decrease in employment numbers as age increases, reflecting that two of the larger industries in the sector (food and beverage services and recreation and entertainment) draw heavily on younger workers looking for part-time employment.

The gender split is relatively evenly balanced: in the youngest group there are more women than men, and across the older groups there are slightly more men than women, but on the whole, there are no strong gender trends at this aggregate level. However, the picture changes when we consider each industry group in turn (see Figures 2a to 2e, below, which provide a series of snapshots as of April 2023).

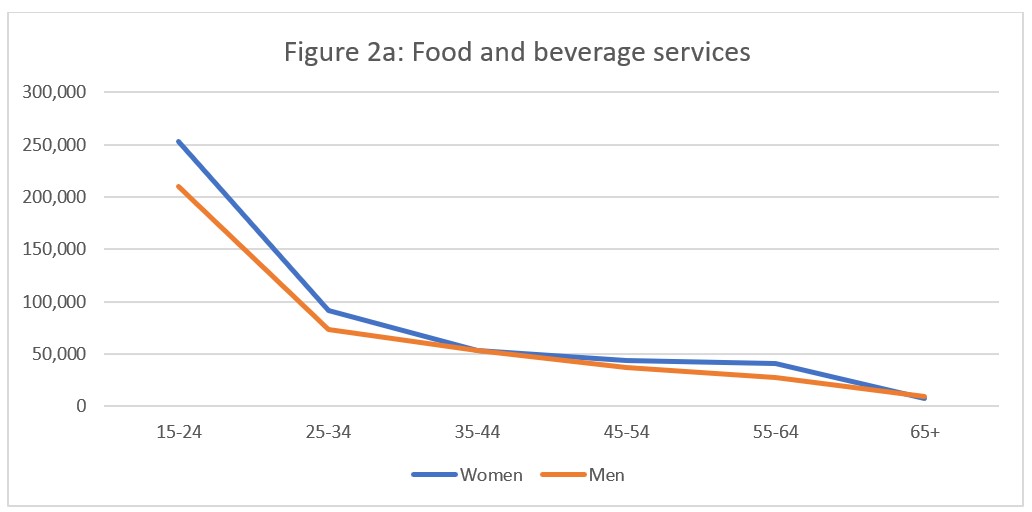

Starting with food and beverage services (Figure 2a), we see the general age split in even sharper relief. Employment drops precipitously between the youngest age group (15-24 years old) and the next (25-34), and then decreases gradually across the age groups. This suggests a lot of people have short-term experience in the industry, but a much smaller number stick with it for a career, or see it as a viable opportunity for a late-entry job. The gender effects are minimal in this industry, with both women and men following very parallel trajectories.

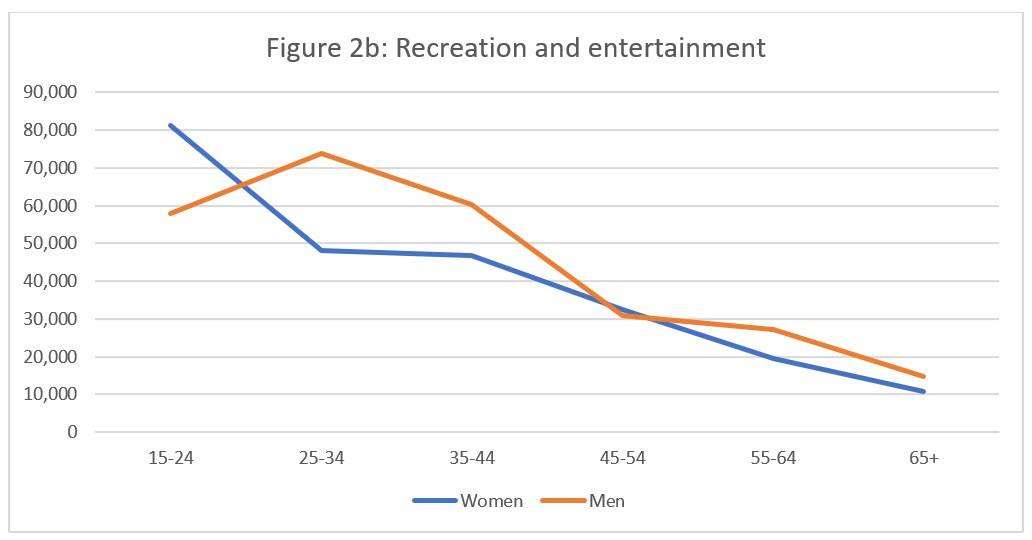

The next largest employer in the sector is the recreation and entertainment industry group (Figure 2b), which comprises a wide range of occupations and businesses and is therefore likely to appeal to a broader range of the working-age public. Overall, the pattern is not dissimilar to what we saw with the sector as a whole or with food and beverage services: generally higher participation in younger age groups, and gender fluctuations in the younger groups even out in the older groups. Women are substantially over-represented in the youngest age bracket, but that reverses between 25 and 44, and then the gap narrows beyond that. The age drop-off is not as pronounced in this industry group as it was in food and beverage services, although the absolute numbers are smaller. As noted, because this industry group covers a wide array of occupations across a number of different settings and operational contexts, it is unsurprising that the rate of participation of mid-career employees remains higher.

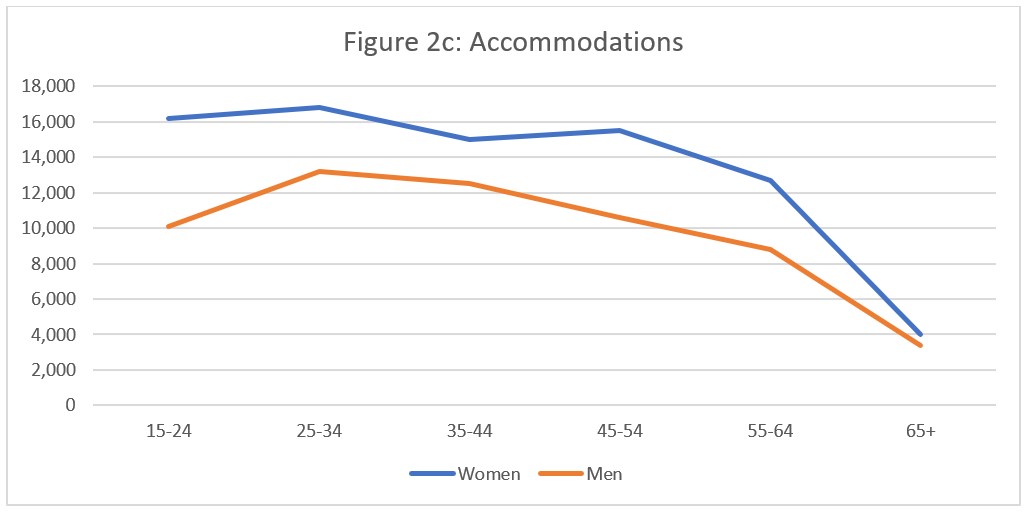

The accommodations industry (Figure 2c) is often perceived as heavily biased towards women (likely due to the ‘domestic’ associations around much of the work) and this perception is broadly help up by the data. That said, the gender gap is less pronounced than we might have expected, given widespread (mis)perceptions. Equally interesting in this industry group is the relatively flat age-related data: while numbers start to decline above 55, the accommodations workforce is much less reliant on younger workers than food and beverage services or recreation and entertainment. This suggests either people staying in employment for longer and building a career, or more openness in the industry to hiring older workers, or more interest in older workers to pursue jobs in this industry—likely, it is some combination of the three.

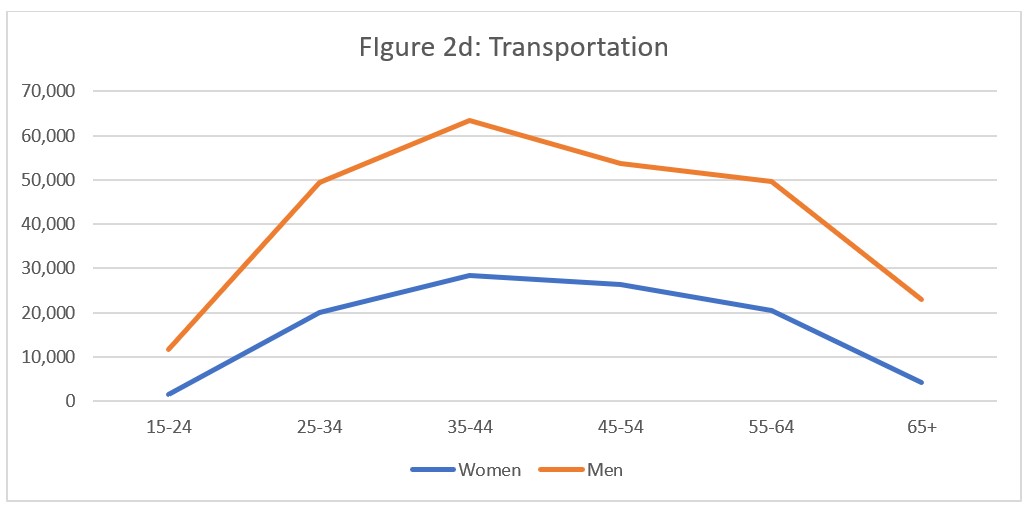

Another industry with strong gendered connotations in popular perception is transportation (Figure 2d), and these cultural assumptions are again borne out by the data: across all age groups, there are approximately twice as many men employed as there are women. Given the technical and licensed nature of many jobs in transportation, it is unsurprising that there are very few young workers. As many jobs in this industry are also unionized, it is also unsurprising to see evidence of career building: having invested in specific (and often expensive) certifications in this field, and working in an environment with strong collective bargaining mechanisms in place, we would expect a number of workers to stay in the industry for extended periods. This is precisely what the data supports.

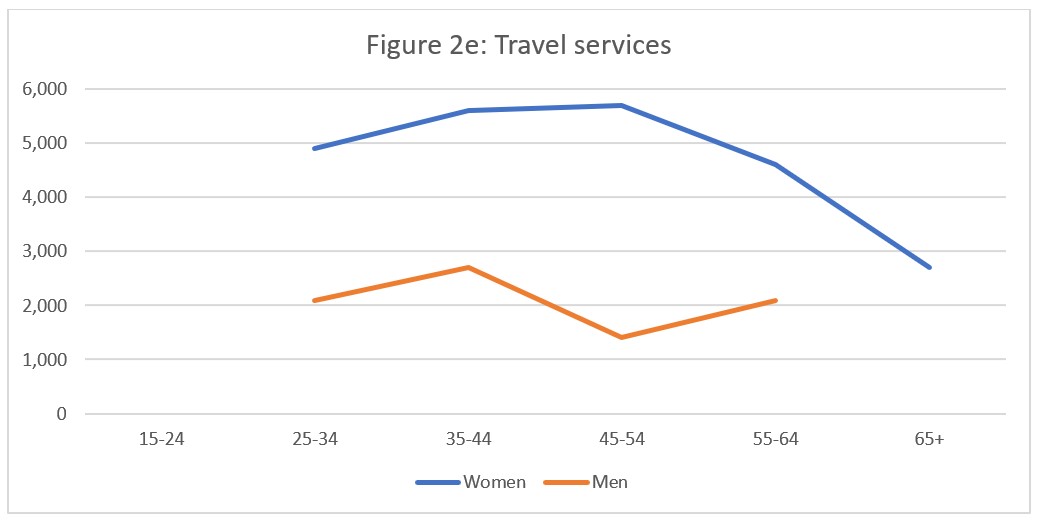

Travel services (Figure 2e) shows the strongest composite gender and age effect, although it is worth remembering that, because this is a relatively small industry within the sector, small absolute differences may be disproportionately amplified through statistical measures. Nevertheless, women make up more than 50% of the workforce in travel services, and seem to stay in the industry to a later age than men. The absence of younger workers (aged 15-24) in this data is not unexpected, given that many entry-level positions in this field require some kind of post-secondary qualification (college or university), which will naturally push the working ages into the next-highest bracket.

General Observations

Where there are strong gendered effects in the distribution of employment across tourism industries, they generally align with common (mis)conceptions of the work in question. When we think of pilots and drivers and ship personnel, many likely imagine men; and when we think of hotel workers, the occupations that come most rapidly to mind include housekeepers and front desk attendants, whom many are likely to imagine as women.

However, these stereotypes do not entirely align with reality: the ratio of women to men in accommodations, for instance, tells us that while there are more women than men, it is by no means an exclusively female workforce. This reflects the reality of the range of jobs available in accommodations, which are not popularly associated with the industry (e.g., skilled trades and financial/managerial roles), alongside the more public-facing occupations that have more gendered popular perceptions.

There is a broad social push to encourage more women to work in trades and licensed professions, so it likely that the ratio of men to women in transportation will shift over time, although it will likely take several years for the numbers to start to shift, given the length of training necessary in many transportation jobs (e.g., airline pilots, ship personnel, commercial drivers).

Where there are strong gendered associations linked to particular occupations, businesses (and the sector as a whole) need to do more to attract a more diverse range of workers, or risk facing ongoing and escalating staffing pressures.

The unfortunate reality is that jobs dominated by women tend to be seen as less prestigious, so as women pursue more prestigious career options, it will become increasingly difficult to fill these positions domestically. International workers can meet some of those needs, particularly for people from countries where tourism jobs are seen in a more positive light, but the narrative of careers in tourism needs to change in any event.

Initiatives such as Discover Tourism are an excellent starting point for reframing tourism as a desired career destination, but more focused work on specific industries—or occupations—will likely be needed.

View more employment charts and analysis on our Tourism Employment Tracker.