It’s hard to estimate exactly how the spread of COVID-19 will affect Canada’s tourism businesses and employees. We do know it will be big and it will be negative.

Any preliminary estimates are by necessity based on limited available information and subject to change and revision. Tourism HR Canada will be monitoring the effect closely and providing updates as soon as they are available.

Here is some of what we do know.

Historically, March is a low point during the year for tourism employment. After seeing an increase in February driven by winter recreation activities, employment drops in March and then begins a steady climb that peaks in August, although in two of the past seven years that peak has come in July.

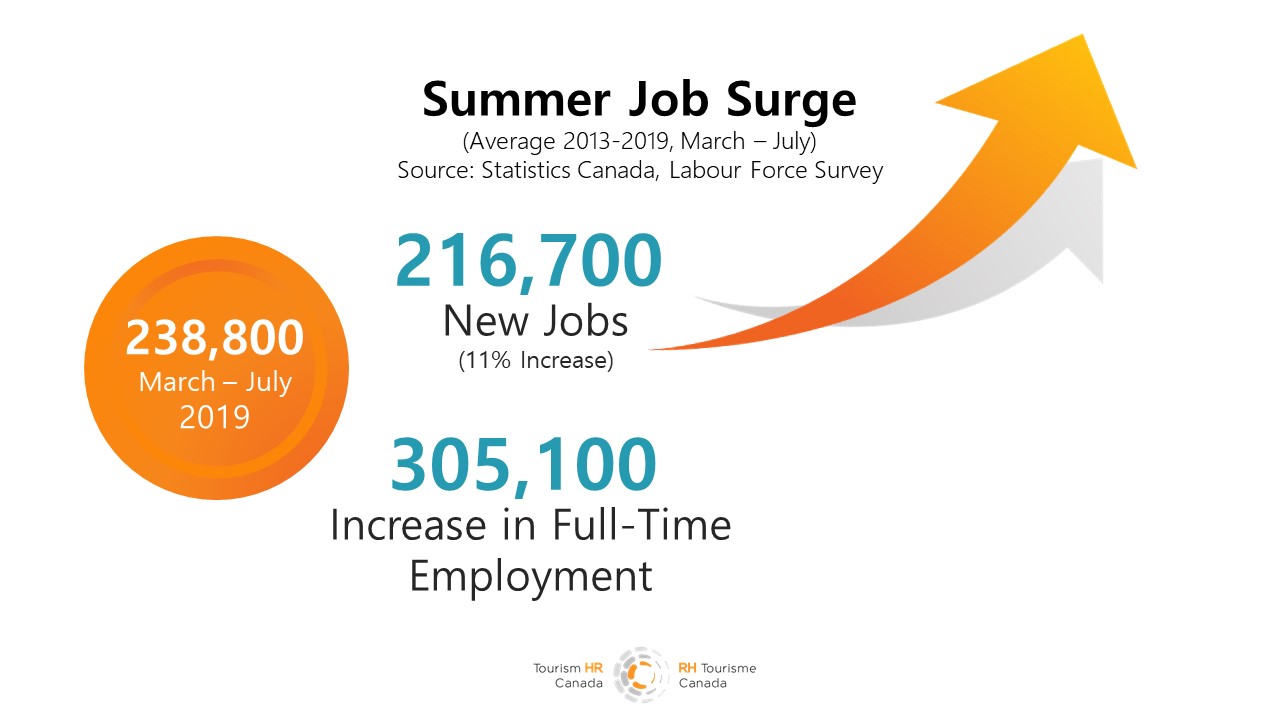

On average, from 2013 to 2019 the tourism sector added 216,700 workers from March to the summer peak, an increase of 11% on March employment numbers.

In addition to the overall increase, full-time employment increases while part-time employment decreases, as year-round workers see their hours increase as seasonal demand peaks. Over the past seven years, full-time employment has increased by an average of 305,100 workers, while part-time employment has decreased by 88,300 individuals between March and the summer employment peak.

In 2019, tourism added 238,800 workers to its labour force between March and July, an increase of 11.7%.

Tourism is not monolithic. It is made up of many industries that derive revenues from different sources. How industries react and recover will depend on many variables. One of these is their revenue source.

Tourism businesses serve tourists, obviously. But to varying degrees, they also derive revenues from non-tourism sources. Restaurants are a good example. They are a key part of the tourism sector but most of their customers are locals.

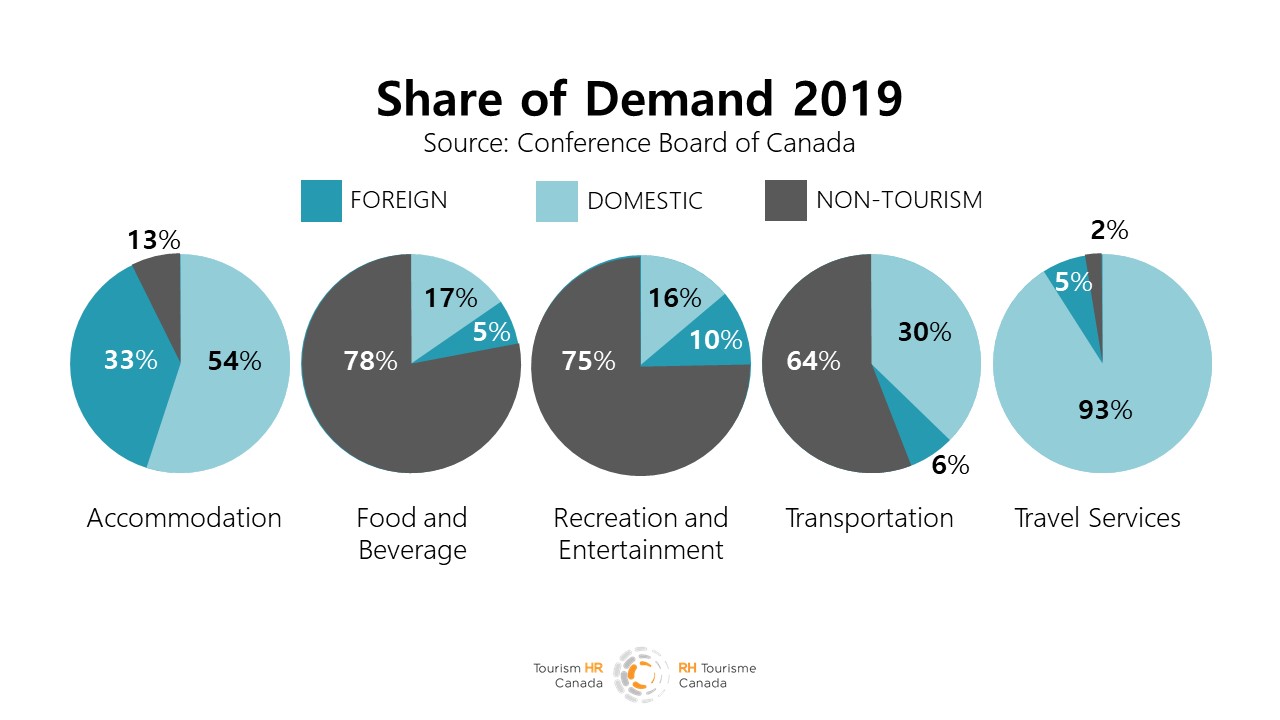

Data from the Conference Board of Canada shows the share of demand in each industry from the year 2019, broken down by source (foreign tourism, domestic tourism, and non-tourism, i.e., local spending).

The industries that have the greatest share of demand stemming from foreign tourism were the first to feel a hit as travel from affected countries was cancelled and international arrivals and outbound travel began to drop. These industries are likely to see the longest lasting impacts. In general, tourism demand is likely to be restricted for some time, greatly affecting accommodation, transportation (particularly air and rail), and travel services.

Industries like food services, recreation, and other transportation (buses, tours, and taxis) derive 75 to 80 percent of revenue from non-tourists, but are of key importance for the tourism sector. Imagine a tourism sector with no restaurants, taxis, or museums. Normally, because they draw on locals, they manage downturns in international and domestic travel with less effect. However, with such a large share of their revenue stemming from people in the community, the necessary restrictions on movement within communities will have a massive negative impact on restaurants, museums, casinos, theatres, and bus and taxi companies, among others. While these industries should see the quickest bounce back in demand once local restrictions on movement are lifted, the longer those restrictions are in effect, the greater the impact on the tourism sector overall.