Tourism HR Canada’s latest report, The Post-COVID Future of the Tourism Workforce, takes an in-depth look at the systemic issues facing the tourism sector’s labour force and at the effect of COVID-19, and recommends how to make the tourism sector more sustainable and resilient as we recover from this crisis. While the primary focus is employment-related considerations, broader economic, social, and political factors are also considered to contextualize the findings.

[popup_anything id=”11508″]

COVID-19: The Impact

Tourism has been the hardest-hit sector of the economy and faces significant challenges on its road to recovery.

Economic activity in tourism, including all sources such as local residents, has dropped much further than economic activity in other industries. Using January 2020 as a baseline, the gross domestic product (GDP) across all industries had not fully recovered to pre-pandemic levels by February 2021. GDP stood at 98.1% of January 2020 levels. However, across all tourism-related industries, GDP was only 58.1% of pre-pandemic levels.

Since the start of the pandemic, many businesses have been forced to close due to a lack of tourists and to public health measures that have restricted their ability to serve local customers as well. As of January 2021, there were 9.8% fewer active tourism businesses operating than there were one year earlier. By tourism industry group, the reduction in active businesses ranged from -2.2% in the accommodations industry to -27.9% in the travel services industry.

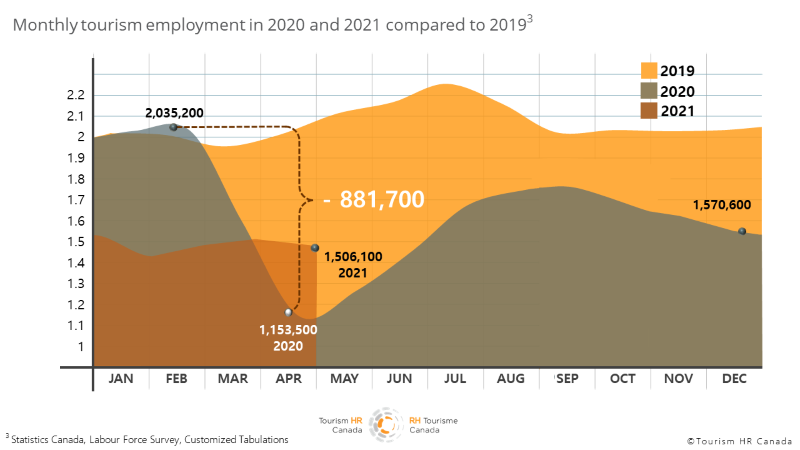

In the first two months of the pandemic, employment in tourism dropped by 43.1%. Employment levels started rising in May 2020, but over the summer, the tourism sector employed approximately 450,000 fewer workers than in 2019, depending on the month. Employment dropped once more in the fall. With tourism essentially non-existent since the summer of 2020, tourism employment levels have risen and fallen in response to public health orders. Outbreaks of COVID that resulted in lockdowns caused tourism employment to drop anywhere from 15% to 23%. As of April 2021, tourism employed 520,000 fewer workers than it had in February 2020, the last month before the pandemic reached Canada, an employment drop of over 25%.

Recovery: Different Speeds and the Importance of Local

Across the country, there are still some uncertainties about the pace of vaccination and the timelines for easing restrictions. But the provincial/territorial reopening plans being developed and implemented allow businesses to begin planning for an ongoing and sustained recovery.

That said, it is important to recognize that the “tourism recovery” will happen at different speeds, depending on industry and region. Tourism industries such as restaurants and recreation facilities that derive significant demand from locals (i.e., non-tourists) will have opportunities to recover earlier than those that rely on domestic tourists. Businesses that rely heavily on international travel face the longest recovery outlook. Regardless of whether they serve a local or a tourist, summer remains a key season for the industry. Tourism businesses in regions that open in June, July, and August 2021 (the earlier the better) will be at an advantage over those that can not. That said, tourism operators’ greatest concern is a fourth wave that leads to another lockdown. Another shutdown in the summer would devastate the sector—which calls for cautious management of the reopening.

When restrictions lift, there is likely to be significant demand for tourism goods and services from residents and domestic tourists. Demand will be driven by the increasing speed of vaccination rollouts, improving consumer confidence, building travel demand, and a substantial number of households (those that were fortunate enough to continue working during the pandemic) starting to spend some of the savings they have built up.

That economic activity is likely to be regionally focussed. There will be little international travel demand until the border reopens and some significant drivers of domestic tourism will be missing. In Ontario, indoor attractions such as museums and art galleries will not open until the final phase of the province’s reopening plan. Across Canada, major festivals, sporting events, and conferences have been cancelled. Inability to access major indoor attractions, or attend major events, will dampen travel to the host locations. A knock-on effect will be felt by hotels and, to a lesser degree, restaurants.

But Canadians do want to get outside and travel after over a year of the pandemic. Limited in terms of international or inter-provincial travel options, they will shift their travel plans to destinations closer to home, with a particular focus on outdoor-oriented activities. Last year, many individuals and families travelled to cottages, campsites, and other getaways within their own or neighbouring provinces, with campsites booked up at overwhelming rates across the country. 2021 is likely to be similar.

The most likely scenario is that some regions will see significant spikes in customer demand—with an accompanying need for workers. At the same time, customer demand will remain below pre-pandemic levels in urban centres due to missing international travel, business travel, and the continuation of work-from-home arrangements.

Implications for the Workforce

As demand returns, reattracting the displaced workforce is a key priority for the sector. Stakeholders across the board are highly concerned that displaced workers will not return to the industry even when the pandemic is over, leading to labour shortages for operators. Even if workers do return, businesses in those regions that see significant demand will be challenged to restaff quickly enough. One concern raised by businesses owners is that the loss of core, long-term staff means they will need to operate with a less experienced group of workers during the early phases of the recovery. Some good news on this front is that that recent surveys show that three-quarters of tourism businesses held onto a core group of staff throughout the pandemic—even though it came at a financial loss.

Of additional concern, perceptions of the industry as a place of work amongst the general population and current and former tourism workers have deteriorated during the pandemic. COVID-19 has negatively impacted desire to work in tourism, perceptions of safety and comfort while working in the sector, and perceptions of job security. Many workers are concerned about low wages and compensation, securing reliable hours, career development opportunities, and the industry’s stigma of being low-skilled with poor job security.

In the long-term, more focus is needed on reforming immigration pathways that align with the tourism industry. Regardless of the immediate short-term summer staffing challenges, the future workforce relies on immigration. Between 2017 and 2018, net immigration accounted for 80% of Canada’s population increase. By the early 2030s, Canada’s population growth will rely exclusively on immigration. Canada’s current and future prosperity depends on recruiting immigrants

The tourism sector’s recovery is starting, but from a policy perspective it is important to remember that the industries that rely heavily on domestic and international tourism face a longer recovery time and greater likelihood that former staff will permanently move to other industries.

The tourism sector’s focus has been on maintaining business operations and using available supports to stay financially afloat. Those concerns are not about to disappear, but as the visitor economy reopens, there is a pressing need to focus on the workforce to ensure the resurgence in customer demand can be met.

[popup_anything id=”11508″]